Getting My Palau Chamber Of Commerce To Work

Table of ContentsExcitement About Palau Chamber Of CommerceGetting The Palau Chamber Of Commerce To WorkSome Known Questions About Palau Chamber Of Commerce.The Best Guide To Palau Chamber Of CommerceThe 15-Second Trick For Palau Chamber Of CommerceAll about Palau Chamber Of CommerceThe Buzz on Palau Chamber Of CommerceThe Basic Principles Of Palau Chamber Of Commerce

A Biased View of Palau Chamber Of Commerce

donation size, when the donation was contribution, who donatedThat gave away muchJust how how they just how to your website, site) Finally, lastly pages contribution it convenient and hassle-free and also straightforward donors to give!

Be certain to gather email addresses and various other appropriate data in a proper way from the start. 5 Take care of your people If you have not taken on employing and onboarding yet, no concerns; now is the time.

There are lots of contribution software program out there, as well as not utilizing one can make on-line fundraising rather inefficient or even impossible.

Not known Facts About Palau Chamber Of Commerce

As an outcome, nonprofit crowdfunding is ordering the eyeballs these days. It can be utilized for certain programs within the company or a basic donation to the cause.

During this step, you might want to assume regarding landmarks that will suggest a possibility to scale your nonprofit. Once you've operated for a little bit, it's crucial to take some time to believe about concrete development goals.

Things about Palau Chamber Of Commerce

Resources on Beginning a Nonprofit in various states in the US: Beginning a Not-for-profit Frequently Asked Questions 1. Just how much does it set you back to begin a nonprofit organization?

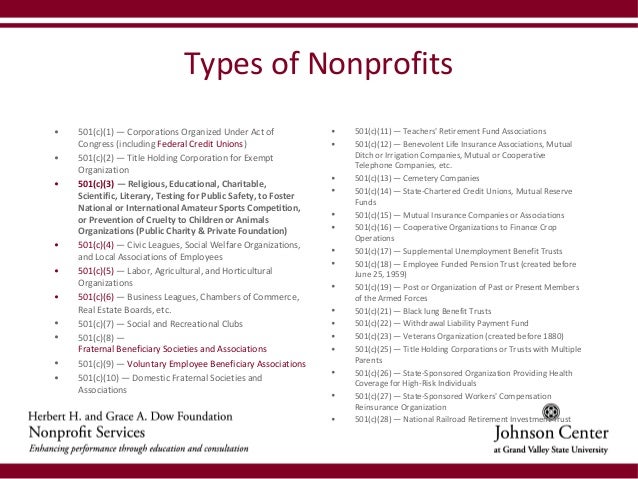

For how long does it take to establish up a not-for-profit? Depending upon the state that you're in, having Articles of Unification approved by the state government might occupy to a few weeks. As soon as that's done, you'll need to get recognition of its 501(c)( 3) condition by the Internal Earnings Solution.

With the 1023-EZ form, the handling time is typically 2-3 weeks. 4. Can you be an LLC and a nonprofit? LLC can exist as a nonprofit limited liability firm, however, it should be entirely possessed by a solitary tax-exempt nonprofit organization. Thee LLC should also meet the demands according to the IRS mandate for Restricted Responsibility Firms as Exempt Company Update - Palau Chamber of Commerce.

Our Palau Chamber Of Commerce Diaries

What is the distinction between a structure and a not-for-profit? Foundations are typically moneyed by a family or a corporate entity, but nonprofits are funded with their profits as well as fundraising. Structures generally take the cash they started out with, invest it, and after that disperse the cash made from those investments.

Whereas, the added cash a not-for-profit makes are made use of as operating prices to fund the organization's mission. Is it difficult to start a nonprofit organization?

There are a number of steps to begin a nonprofit, the barriers to entrance are relatively few. 7. Do nonprofits pay taxes? Nonprofits are excluded from government income taxes under section 501(C) look at this website of the IRS. Nonetheless, there are particular situations where they may require to make settlements. If your nonprofit earns any type of revenue from unrelated activities, it will certainly owe income taxes on that amount.

The Best Guide To Palau Chamber Of Commerce

The function of a not-for-profit organization has actually constantly been to create social change as well as blaze a trail to a much better world. You're a leader of social modification you can do this! At Donorbox, we prioritize services that help our nonprofits enhance their donations. We understand that financing is crucial when beginning a not-for-profit.

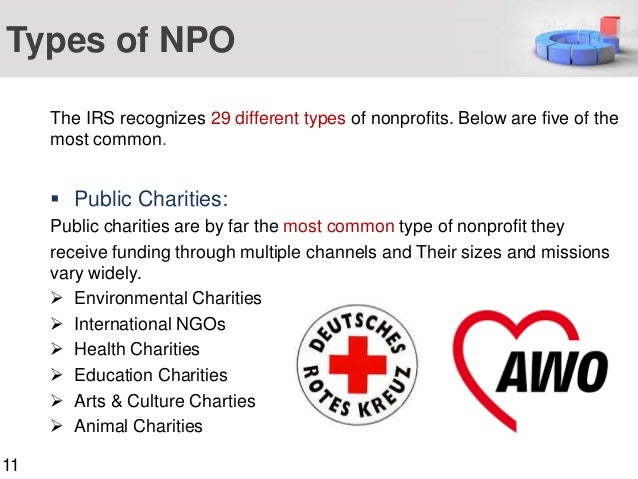

By far the go to my blog most typical kind of nonprofits are Section 501(c)( 3) organizations; (Area 501(c)( 3) is the component of the tax code that licenses such nonprofits). These are nonprofits whose objective is charitable, religious, academic, or clinical.

This classification is very important because personal structures undergo stringent operating rules as well as laws that don't put on public charities. Deductibility of payments to an exclusive foundation is a lot more restricted than for a public charity, and private foundations are subject to excise tax obligations that are not imposed on public charities.

The Single Strategy To Use For Palau Chamber Of Commerce

The bottom line is that personal structures obtain a lot even worse tax treatment than public charities. The primary difference in between private foundations as well as public charities is where they get their financial assistance. An exclusive foundation is typically controlled by a specific, family members, or firm, and also acquires most of its revenue from a couple of contributors as well as financial investments-- a good example is the Expense as well as Melinda Gates Structure.

This is why the tax law is so difficult on them. A lot of structures simply offer cash to various other nonprofits. Nonetheless, somecalled "running foundations"operate their own programs. As a sensible issue, you require a minimum of $1 million to start an exclusive foundation; or else, it's unworthy the difficulty and expense. It's not shocking, then, that a personal structure has been described as a huge body of money bordered by people that desire several of it.

Other nonprofits are not so lucky. The internal revenue service initially assumes that they are exclusive structures. Palau Chamber of Commerce. However, a brand-new 501(c)( 3) company will certainly be classified as a public charity (not a personal structure) when it applies for tax-exempt standing if it can reveal that it sensibly can be expected to be publicly supported.

7 Simple Techniques For Palau Chamber Of Commerce

If the internal revenue service categorizes the not-for-profit as a public charity, it keeps this standing for its very first 5 years, navigate to these guys no matter of the general public assistance it in fact receives throughout this time. Beginning with the not-for-profit's 6th tax year, it has to show that it satisfies the general public support examination, which is based upon the assistance it gets throughout the current year as well as previous four years.